Personal Insurance

Although there are different types of personal insurance, the common goal of each of them is to protect what really matters to you.

Long Term Care Insurance

Long Term Care Insurance is an insurance product that helps pay for the costs associated with long-term care that it is generally not covered.

Long Term Care can cover assisted living, home care, respite care, hospice care, nursing home among others.

The recommended age to shop for Long Term Care insurance is between 45 and 55 as part of an overall retirement plan to help protect assets from the high cost

of extended health care.

Medicare

Medicare is a National health insurance program that provides health insurance for Americans aged 65 and older. Younger people with some disability’s status and people with certain disease as ALS, renal disease among others can also be covered under the Medicare plans.

On average, Medicare covers about half of healthcare expenses of those enrolled. Medicare is funded by a combination of payroll tax, beneficiary premiums, co-pays and deductibles and general US Treasury Revenue.

Medicare is divided into four Parts:

- Medicare Part A covers hospital*, skilled nursing* and hospice services (*patient

formally admitted to a hospital). - Medicare Part B covers outpatient services and prescription drugs.

- Medicare Part C covers Medicare Advantage Plans.

- Medicare Part D covers mostly self-administered prescription drugs.

Short Term Disability and Long Term Disability Insurance

There are two types of Disability Insurance, Short Term and Long Term, these types of insurance will pay you part of your income if you can’t work because of an illness or injury. The Short Term Disability Insurance usually pays part of your income for a few months up to a year, while the Long Term Disability Insurance may pay you benefits for a few years or until disability ends.

Some employers may offer these types of benefits on a group basis.

Life Insurance

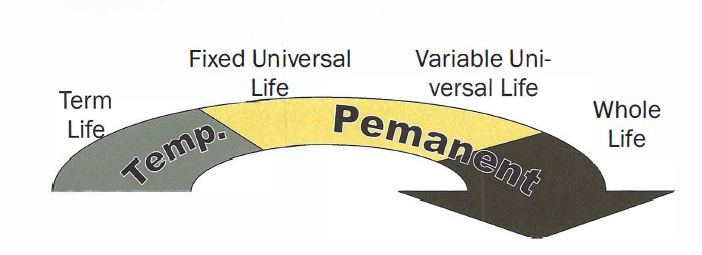

Life insurance policies can vary widely in their features and purpose.

Term Life:

Death benefit, fixed rate periods available for limited periods of time

(ex. 5yr., lOyr., 15yr., 20yr., 30yr.). This is the least expensive way to insure a life.

Fixed Universal Life:

This is a permanent life insurance policy that can build some cash value. A fixed rate of return is offered, and premiums remain guaranteed for the life of the policy. This is the second least expensive way to insure a life, and is the lowest cost version of permanent insurance.

Variable Universal Life:

This is similar in function to the fixed universal policy however the rate of return on the policy is determined by investment performance of sub-accounts provided in the product. Market performance can help this policy to grow sizable cash values overly time, however poor market performance can have the opposite effect. It is important to remember that poor market performance may also make additional contributions to the plan necessary.

Whole Life:

This is a permanent life insurance policy that bases it rate of retu1·n on dividends paid by the insurance company. Returns are stable and can produce significant cash value over time. These polices have higher premiums than the three previous options.